Frequently asked questions

1. Where can I view my interest rate?

Please click here to log into our Online Banking site. Once logged in, click your Ultimate Money Market account to view the current interest rate.

2. Are you FDIC insured?

Yes, Northpointe Bank is FDIC insured. Our FDIC number is #34953.

3. Does the rate apply to the full balance?

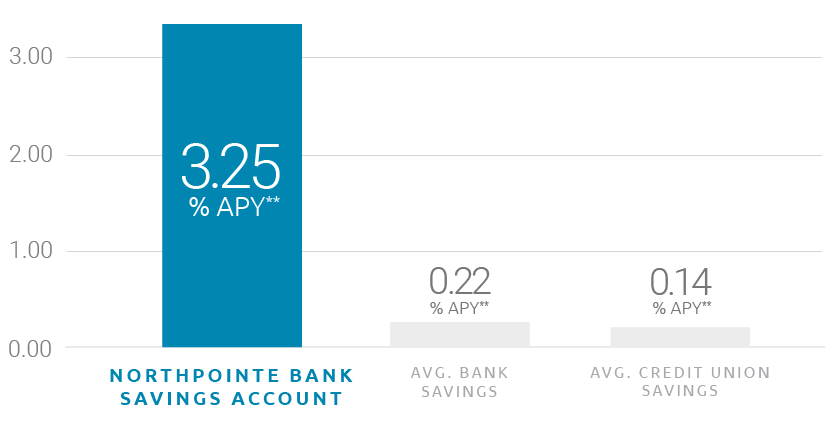

The 3.25% APY applies to the full balance if the balance is between $25,000 - $3,000,000.

4. How can I move money in and out of the account?

There are several options for moving funds in and out of the account:

Deposits In

- Mobile Check Deposit via our Mobile Banking App – transaction limits vary by account

- ACH in initiated via our External Transfer service within Online Banking – up to $25k per day & $250k per month

- ACH in initiated from your bank, credit union or PayPal/Venmo type service – no transaction limits

- Wire transfer in – no transaction limits

- Mail us a personal check, cashier’s check, or bill pay check – no transaction limits

Withdrawals Out

- ACH out initiated via our External Transfer service within Online Banking – up to $25k per day & $250k per month

- ACH out initiated from your bank, credit union or PayPal/Venmo type service – no transaction limits

- Wire transfer out (fee applies) – no transaction limits

- We can mail you cashier’s check via USPS delivery (fee applies) – no transaction limits

5. Can the account be opened in the name of a trust?

Yes, we allow accounts to be titled in the name of a trust. As an alternative, you can also designate the trust as a beneficiary.

6. Do you offer checks, debit card, or bill pay on this account?

Yes, our money market account allows for checks, debit cards and bill pay. Checks and debit cards are not automatically ordered with money market accounts. Contact the personal banker coordinating your new account opening to request these services. A fee for check orders may apply.

7. What are the fees and minimum balance requirements?

There is no monthly maintenance fee or minimum balance requirement to avoid a fee. Our full fee schedule can be reviewed here: https://www.northpointe.com/fee-schedule/

8. How is the interest calculated and when is it credited?

Interest is calculated on the daily balance and credited monthly on the last business day of each month.

9. Is the Ultimate Money Market a checking or savings account?

Although it’s typically used as a savings account, it is technically a checking account. When setting up any linked external accounts, direct deposits, or automatic withdrawals be sure to classify the Northpointe Bank Ultimate Money Market as a “checking” account.

10. Is this promotion also available on business or non-profit accounts?

This promotion is available on personal, business and non-profit accounts. It is not available on Individual Retirement Accounts (IRA).