Ease your way into homeownership

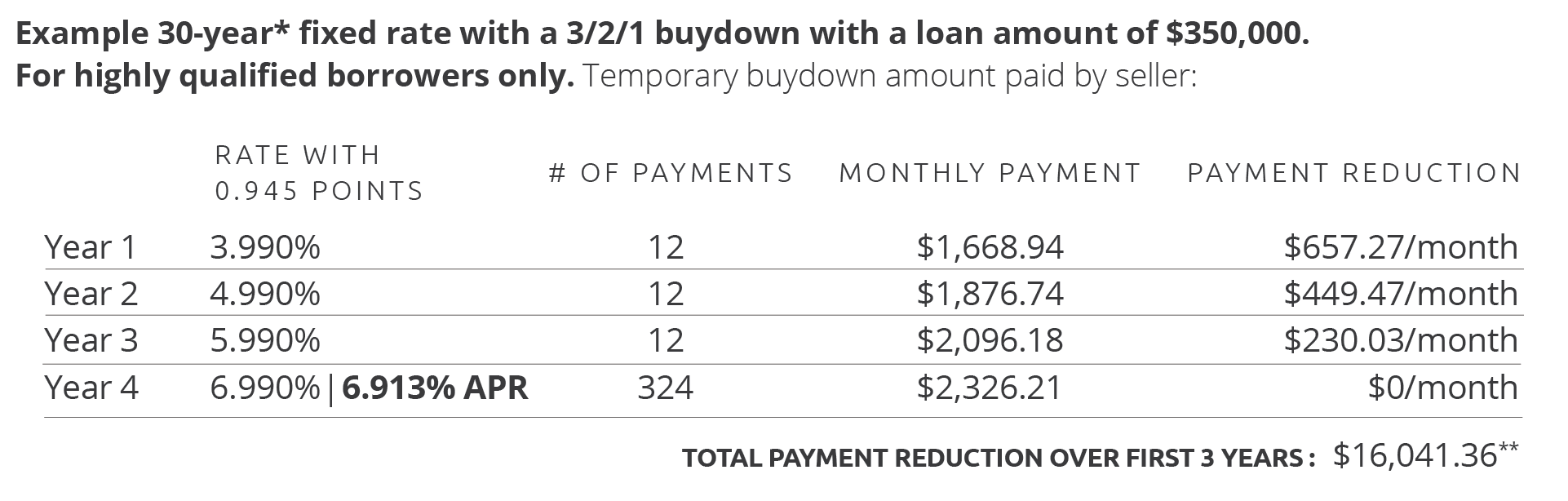

With the Northpointe Bank temporary buydown option, your interest rate may be bought down for up to three years at the beginning of the loan, reducing your initial monthly payments. Buydown options are eligible for FHA, VA, Conventional Conforming & High Balance purchases only.

Combine this feature with one of our custom-tailored home loan programs

*Interest rates as of July 1, 2025, and subject to change without notice. Annual percentage rate (APR) based on an owner-occupied single-family residence with a loan amount of $350,000, credit score of 780 and down payment of 5% with tax and insurance escrows required. The 30-year fixed rate APR is 6.365% and based on a note rate of 6.500% with 0.316 points at a cost of $1,106.00 and $2,212.24 principal and interest payments. Payment amount shown does not include taxes and insurance premiums. The actual payment amount will be greater.

**Buydown amount of $15,652.80 varies based on loan amount and note rate. This is not a commitment to lend. All loans are subject to credit review and approval. Not available with all loan programs. Other terms and conditions may apply.